I wrote this article several years ago, but it’s still a largely valid overview.

Infinity? For 150 years, the developed world has been awash in oil. Supply seemed infinite. Regulation mechanisms such as the Texas Railroad Commission acted to limit excess production. But now we’ve reached the end of infinity. The world is facing a future of declining oil production, at least of the sort of oil resources that cheap and easy to extract. That means everything that depends on oil, which is almost everything in our civilization, will suffer. The decline will affect all aspects of life, for both good and ill, probably the ill first. How far we travel, where we live, what we eat, and what work we do–all will change. We can plan for it, or be surprised by a painful paradigm shift.

How does oil affect everything? Start with the vehicles we drive. What does it cost to fill the fuel tank of a car or truck? What if that doubled, like it did in 2008, and then doubled again, and then again? Many of us would drive a lot less to save money for food and to pay our debts. But when we do go to the store and buy, say, a soft drink, the cost of that may have doubled or tripled. The most important ingredient in soft drinks today is corn syrup. American agriculture is mechanized; massive machines that burn diesel fuel plant and harvest the crops. The fertilizers, pesticides, and herbicides are all produced from oil. The farmer’s costs will have soared, as did the costs of the food processor who makes the corn syrup and bottlers and shippers who make and move the finished product. What about long-distance travel? An airplane burns an enormous amount of jet fuel for a transcontinental flight. Even at low fuel prices, airlines have wandered in and out of bankruptcy. Most of us will never fly again after most airlines fail. If we try to save money by driving (maybe carpooling) to Walmart, the American outlet for inexpensive Chinese manufactured goods, we’ll find fewer items on the shelves and much higher prices. The plastics used to make so many products will have gotten very expensive, since plastic is made from oil. And worse, the shipping costs for the monstrous container ships that bring the formerly cheap products here will have doubled and doubled again, because the ship burns oil-based bunker fuel. The trucks and trains that carry the products from the ports run on diesel, another oil product, so there’s no relief there. Trains are a more cost-effective way to ship than truck, so a lot of freight traffic will shift to trains. More on trains later. Those shipping costs are buried in the purchase price of the Chinese products. All goods, services, and transit in our society have costs tied to the cost of oil.

Why is oil going to get expensive? In 1998, I read Colin Campbell and Jean Leherre’s article in Scientific American, “The End of Cheap Oil”. They explained that in a conventional oil field, the yield curve over the useful life of the field is bell-shaped. The field is found, multiple wells are drilled, production increases. Once a large fraction of the oil is pumped out, the remainder becomes much harder to extract and production drops. The first person to notice this was the geophysicist M. King Hubbert in the 1950s. He analyzed U.S. oil production and estimated it would peak and decline in 1970. U.S. production did in fact peak and decline in 1970, but other reserves from around the world were brought into production and much more than made up the difference. However, those reserves are subject to the same laws of geophysics as U.S. reserves. Based on their analysis, world-wide oil production would peak within 10 years. After I read that I went out and bought a car that got 35-42 miles per gallon. I wasn’t really affected by the 2008 price spike to $4/gallon. These days I’m driving a Prius, but at $10/gallon even the Prius won’t look so good.

Where’s oil from? Oil and petroleum are the catch-all names for the liquid hydrocarbons that can be found in certain porous sediments of the Earth’s crust when conditions are just right. Plants use the energy of sunlight to collect nutrients from the air and soil to grow. Most of the plant is molecules made from atoms of carbon and hydrogen collected from the air and water. They pick up a bit of nitrogen from the air and small amounts of other stuff like sulfur, phosphorus, etc. from the dirt. They dump the unneeded oxygen atoms, which animals like us breathe in to oxidize food into energy. Fortunately, the plants tend to stay ahead of the animals, so there’s still oxygen to breathe and plants to eat. When the plants (and I’m including algae in water) die their bodies end up in the dirt on the land or the mud of the lake or sea bottom. After a few million years, a lot of hydrocarbon molecules collect in the dirt or mud. Cover it up with other layers of dirt, sand, and mud and the result is thousands of feet of sedimentary rocks you see in places like the Grand Canyon. The sediments with lots of hydrocarbons get compressed under enormous pressure and transformed. The dead plants turn into the three classes of hydrocarbons we like to burn: some becomes a gas, some solid, and some liquid. Natural gas is mostly methane, consisting of one carbon and four hydrogens, which we collect, pipe, and burn. On the weird side, it turns out that the dead plant material also collects at the edges of the continents, where it gets broken down into methane by bacteria and trapped in a strange colloidal suspension with water; like frozen, very flammable jello. Some of this “methane hydrate” turns up in other cold places, too. Scientists think there’s more methane and its close relatives in the crust of the earth and continental edges than any other hydrocarbon–a lot more. If the dead plants get compressed enough so the hydrocarbons become mostly carbon, the material turns into something that resembles rock; coal. There’s a lot of that, too. Burns okay, pollutes like crazy, and it doesn’t travel well. Lastly, if the hydrocarbons get compressed just right and they’re the right size molecules, they turn into a liquid that’s a mixture of different sized chains of carbon atoms stuck together with some hydrogens attached, too. The liquid is lighter than the rocks around it and tends to get pushed toward the surface through cracks and pores in the rock. When it reaches the surface, the liquid tends to evaporate over time and get broken down by bacteria. What’s left for awhile is the tar you see at places like the LaBrea Tar Pits in Los Angeles, which also is an oil producing region, or the vast tar sands of Canada. With luck, a bit of the oil gets trapped before it gets to the surface by a cap layer of rock that isn’t porous and doesn’t have big cracks. The oil is still under great pressure. Drill a hole and get out of the way, lest the famous gusher comes out in your face. Initially the oil in an oil field wants to escape–all oil wells work by using the natural pressure that’s trying to force the oil to the surface. Trouble is, once oil gets out, pressure eases and production drops. That’s when petroleum engineers start encouraging the oil by injecting water or gas to keep the field pressure up. That costs money, making the oil more expensive to extract. Production still drops eventually. Even under the best geologic conditions, combined with careful extraction management, producers only get at most 70% of the oil. The global average is around 35%. The same thing happens with natural gas wells, but they drop off even more quickly than oil wells, since it’s a compressed gas. There’s also something called oil shale. That’s sedimentary rock with lots of hydrocarbons embedded, termed kerogen, that could become oil with some more pressure and heat. People keep trying to extract oil from the shale by adding the pressure and heat, and keep finding out it’s too expensive to make any sense. Most of the oil that people are finding these days is deeper, harder to get, and often of poor quality; thicker and/or with too much sulfur. Sulfur complicates refining and is hard on transport and storage systems, to say nothing of engines. Regardless of location and quality, there’s not much new oil compared to what was found in the big fields, which are starting to decline in production. Discovery of the big, easy pockets peaked in the 1960s and it’s been downhill ever since.

Why do we like oil? To travel any distance, most people don’t use their legs or muscle-powered transport. They control a vehicle, a force multiplier machine, that generates hundreds to thousands of times the effort they can produce with their own muscles. That requires burning significant quantities of a hydrocarbon with high energy density to power internal combustion engines or turbines. There’s nothing like a good tank of refined oil to move a car, truck, boat, airplane, or locomotive. Oil can be moved in pipelines across land, in tanks using trucks or trains, or in really big tanks across water on oil supertankers. By heating it up some to separate the different molecule sizes, i.e. refining, oil can be seperated into different grades of fuel that run different kinds of vehicles. We can take some of the molecules and make them into petrochemicals; plastics, fertilizer, pesticides, and many other useful products. Natural gas takes up much more space and produces less energy when it’s burned. Even compressed in tanks in trucks, cars, and buses, those vehicles don’t have nearly the range they would with a tank of gas or diesel. Natural gas is great in situations where it can be fed to the turbine at a power plant or burn to heat a house. Coal is a mess, except in power plants. Well, it’s a mess there, too. I remember the layer of ash that accumulated on cars at the 4-Corners power plant I visited in the 1970s. Steam ships and steam locomotives were replaced by oil-powered modern engines for a very good reason. Lately, there’s been quite a bit of discussion regarding producing energy with renewables or with nuclear power. None of those systems will fit in or on your car. But what if you plug into the electric grid to store electricity in batteries? Batteries don’t have the energy density of a tank of gas, plus they’re very expensive. The plug-in hybrids are going to start at $38,000-40,000. The low-priced ones will go 11-40 miles on a charge. To go a couple of hundred miles on electricity, you’ll need to drop $50,000 for a Tesla. My Prius, which ultimately gets its energy from burning gasoline, goes over twice that distance on a tank of gas for less than half the purchase price of a Tesla, and many people would consider a Prius rather expensive. Adding batteries to make it a plug-in, as Toyota is doing, adds thousands of dollars to the price for a mere 11 miles on battery alone. And the lithium these batteries use can catch fire or explode.

OK, what are some real numbers? Here’s the force multiplier for oil–15 to 1. Right now, from a decent “conventional” oil field, for every unit of energy put into the field’s production, the producers get 15 units worth of oil energy back. You can also think of that as a rate of return. All the “unconventional” oil sources require more energy to get the oil out, hence poorer return. The multiplier ratio for the Canadian tar sands is only 3 to 1. According to the analysts I’ve read, that means that mining the tar sands doesn’t make good economic sense unless oil prices go high and stay high. Gas and diesel prices eventually have to rise to reflect that 3 to 1 ratio. The implication is that other things being equal, if we’re paying $2/gallon of gas at a 15 to 1 multiplier ratio, a 3 to 1 ratio will pull us toward $10/gallon gas. When there are claims regarding all the petroleum still left in the crust of the earth, and there is a fair amount, the person making the claim often doesn’t have a clue about relative return ratios and hasn’t realized that low return ratios will force higher oil prices. This applies to biofuels, too. The best multiplier claimed for corn ethanol is a ratio of 1.3 to 1, so if we have to depend on corn we’re in really big trouble. Ethanol from cellulose (plant bodies, not the corn kernels) and oil from algae should have better ratios, but I haven’t come across numbers.

How much oil are we using? A barrel of oil contains 42 gallons. The weight of a 42 gallon barrel by volume changes with temperature and the type of oil (light jet fuel versus heavy bunker fuel) contained in the barrel. Refining crude oil usually results in products that are a bit less dense, so a refinery can actually produce more oil products by volume than it receives. The United States uses about 20 million barrels of oil every day. The entire world uses about 84-85 million barrels per day (bpd). Yes, that’s an amazing number. Some people who have studied this think that 89 million bpd is the maximum worldwide production capacity right now. Guess what we hit in 2005 when oil prices started to spike? Recent estimates I’ve seen claim that by 2011 demand potential will increase by 5 million bpd, once again exceeding production capacity. Based on claimed reserves, which are likely inflated in some important cases, the world has 1.1-1.2 trillion barrels of “conventional” oil, although much of that will be unrecoverable as oil field pressures drop. We’ve used 1.3 trillion barrels of oil since 1859. Dividing 85 million bpd into 1.2 trillion barrels gives us 38.6 years of oil left, but we may not get anywhere near the 1.2 trillion out. We tend to remove the easy oil first as it is less expensive to produce. The last drops of the 1.2 trillion barrels may be too expensive to produce. Despite the best efforts of bright and motivated petroleum engineers the highest worldwide production we can attain for now may be around 90 million bpd. Although oil consumption in the developed nations is leveling off and perhaps declining, demand in the developing world continues to surge, resulting in projections of worldwide demand in the next few years that exceed 90 million bpd, by even the most conservative estimates.

What about new oil? As I said, in terms of barrels found, oil discovery measured by field size peaked in the 1960s. We haven’t been finding nearly enough new reserves to match consumption for years. A few months ago the New York Times had an article about the great rate of oil discovery in the first half of 2009, the best since 2000. The new discoveries amounted to 10 billion barrels. At 85 million bpd, that’s 117 days of oil, not even enough to cover the amount actually used in the first 6 months of 2009. And the new discoveries all tend to be in places that are deeper and harder to reach (like way under water) than the easy oil that gives the 15 to 1 return ratio. While we can and should explore aggressively and extract intelligently, the oil that’s left will only cushion the decline somewhat, not stop the decline. I know a petroleum geologist who’s involved in several companies working on creative ways to find and extract every drop possible. I expect those companies will do well.

Why did the price of oil spike in 2008? In a word, stampede. Once an oil well is up and running, the output rate and eventual decline are relatively predictable. People are a different matter. Throughout most of oil’s history, people have had a tendency to keep drilling more wells as long as they could convince investors there was money to be made, find a place where they thought they could find some oil, and then sink a well. During most of the petroleum era, there’s been too much production capacity. Various entities like the Standard Oil Trust and the Texas Railroad Commission worked to withhold supply or limit production and maintain price. When control of most oil production shifted from private companies, largely based in the U.S. and Europe, to national oil companies, the Organization of Petroleum Exporting Countries was formed. OPEC attempted to manage price with both decreases and increases in production. They were at least partially successful. These days OPEC is responsible for about 40% of the world’s oil production. There are enough producers and enough transparency in information exchange relative oil prices around the world, thanks to computers and the Internet, that it’s harder for one entity to control prices. That seemed to be OK as long as production capacity exceeded demand. However, when consumption reached production capacity in 2005, futures trading did what it’s supposed to do–speculate. If economic growth had continued, oil would have continued to be in short supply and very valuable. So the market bet on growth and bid the price of oil up to $147/barrel. Since no one had excess capacity they couldn’t act like OPEC (mostly the Saudis) have in the past; increase production to stabilize price. The big producers like stabile, albeit profitable markets, just like everyone else. Without reserve capacity, there aren’t other good mechanisms to prevent price spikes.

Why did we have a recession? The oil, not the financial system. Financial and economic specialists like to think it was the mortgages and credit, the topics they’re familiar with, that caused the recession, but they’re confusing symptom and cause. “Maverick” Canadian economist Jeff Rubin thinks the real problem was high oil prices. Your transportation fuel doubles or triples in price, your income doesn’t increase, and you are having trouble meeting your payments. What’s going to give, especially if you have an adjustable rate mortgage whose rates jump up? Businesses were affected, too. Most modern economies are very, very dependent on credit. Loans are constantly being made to consumers and businesses to let them function day to day. Loans allow one to buy cars, homes, expand the factory, make payroll, etc. Loans all depend on the lender having some confidence the borrower will repay the loan. Short of a major war, I can’t think of anything that would make lenders more nervous than the cost of everything based on oil becoming expensive and unpredictable. The recession happened all over the world, not just in places like the U.S. with housing bubbles. Our bubble was very visible and had its own ripple effects, but it was not the root cause. Rubin points out that 4 of the last 5 recessions were preceded by a jump in oil prices.

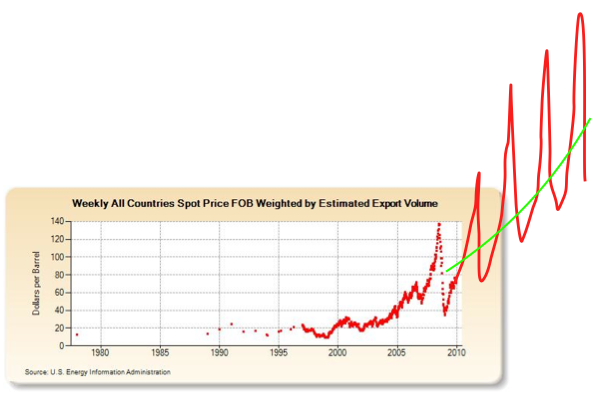

What’s next? An unpleasant roller coaster for some. Countries like the United States, Canada, and the European Union nations let oil prices be passed through to the consumer and to businesses as refined fuels whose prices are tied back to oil. Almost all of the producer nations in which the government runs the oil and natural gas industry divert some of their production to their population, typically at prices that are much lower than market prices. And some of the developing economies, like China and India aren’t producers, but subsidize oil and gas anyway on the theory that low stabile fuel prices keep their citizens happy and their economies working. The International Energy Agency tallied subsidies for the 20 biggest economies after the U.S., Europe, and Canada. At the end of 2008 those subsidies amounted to 310 billion dollars. Not a level playing field, and no reason to think those countries are encouraging conservation. In fact, more cars were sold in China in 2009 than in the United States. Since nothing significant has changed in the ways in which oil is produced, priced and sold, it’s likely there’s another price spike coming in the near future if worldwide economic activity keeps improving. Here’s an oil price graph from the U.S. Energy Information Administration, to which I’ve appended 2 scenarios of future oil prices–

The red dots are real price data. The red line scenario is one of successive price spikes, followed by recessions as we let market forces and speculators “manage” for us. Based on what’s happened, that seems the most likely scenario if we don’t attempt active management in some fashion. The green line scenario presumes that oil price increases as the supply diminishes in a controlled curve. No one’s likely to be happy with either curve, but the wild swings of the red scenario depress entrepreneurial investment in finding new oil or alternatives, and in developing different ways of doing things. We’ve already seen that in the first recession in the series. The swings have national security implications, since a modern military like ours consumes vast quantities of oil-derived fuels. Fuels costs can consume budgets. In the green scenario, people know what to expect and are madly restructuring our society for the post-petroleum age, with investors funding some of the restructuring since they can project the future returns. How many more oil price spikes and subsequent recessions will we suffer before people admit there is a problem and change behavior for the long term, perhaps including some form of price or demand management?

Does it get better? A couple of books I’ve read recently paint scenarios in which food and manufacturing goes local again–the end of globalization. People leave the suburbs for cities, walk more, eat better, and end up with better lives. Of course along the way, we lose entire industries; most cars and trucks, most air travel, entire retail chains, most of the service sector economy, etc. I’m concerned that the transition period with be (literally) murder, especially if we’re on an economic roller coaster. Investors will just want to sit on their money instead of funding local industries and building new infrastructure. Contemplating lots-of-people-die-along-the-way possible futures, if our mechanized agriculture system becomes unsustainable, what happens to the vast amounts of food we export? People around the world will get back to subsistence farming, but with what transitional losses of life and health? I’ve been frustrated for years by our pathologically sedentary society. Some aspects of the petroleum-decline era aren’t frightening since I already bike to work frequently, run and ride long distances for fun, and drive a car that gets about 50 mpg. I work in a branch of education in which some form of my job is likely to continue. However, I wonder about obtaining food, whether I’ll be stuck in my town, how my kids will fare, and how much suffering I’ll see. This boosts the “exercise or die” scare tactics to a new, more unpleasant level.

What can we do? Since Americans burn 20 million bpd, one quarter of the world’s oil production, we have a long way to fall if we’re stupid, but a lot of room for improvement if we’re smart. We’re actually the world’s 3rd largest oil producer at over 8 million bpd, although that’s sure to drop off along with everyone else’s production. I doubt we could control oil prices unless there’s extraordinary cooperation between producers regarding price. To obtain the green line scenario for American consumers, businesses, and our military, we could devise a national price management system that buffers the price swings on the fuels and petrochemicals output side. Presumably that would require government involvement. That would give us a more stabile, predictable, albeit upward-expense-curve future to plan for. Devising a fuels price management mechanism is beyond my rudimentary policy skills. We could also envision some pretty draconian requirements for improvement of the fuel economy of the vehicles that need to run on oil-based fuels, probably combined with actual driving restrictions. All lanes become car-pool lanes, areas with alternatives are closed to vehicles? We should be spending trillions, yes, trillions of dollars to build a different energy and transport infrastructure. Those include rail and bus systems, likely combined with the aforementioned restrictions to encourage ridership. All aspects of our existence that depend on oil and oil products will need to be examined for conservation opportunities. or shifts to alternate energy sources. We should retrofit everything that’s large enough to make sense to use natural gas, and build new vehicles that are designed for that fuel. Natural gas vehicles don’t have the driving range a gas or diesel vehicle has, so long haul truck cargo will need to shift back over to railroads again. There was some shift to rail during the last price spike period. Did you know all train locomotives use electric motors to turn their drive wheels, with diesel engines spinning generators? There’s no reason you can’t take a locomotive, swap out the diesel engine for a natural gas turbine, and spin the generators with the turbine. My non-rail-expert vision is of a couple of natural gas tanker cars tied to the locomotive string. An even better approach would be massive electrification of the rail system, supported by new power generation facilities. We should electrify any transport system we can, presumably tied back to those renewable power generations facilities that are just around the corner, although it’s also easy to generate power with natural gas, which can supply power when the wind isn’t blowing and the sun isn’t shining. Coal and nuclear fuels can be a factor in power generation, but the relative merits and trade-offs of the components of a new electrical generation and distribution system are beyond my expertise. If we’re smart about this, the redesigned infrastructure would be planned to encourage people to put farms and factories where they would do the most good, and to help people locate where they can work, too. You should be picturing another sort of housing boom, since suburbs will need to be unbuilt if they aren’t close enough to jobs, while other, higher density housing will need to built where the jobs are. This will take a lot of natural gas during the transition, but there really is a lot if we can extract the unconventional methanes. It’s just been the illegitimate half-sibling of more valuable oil. That said, the task of finding and extracting natural gas, hopefully with some environmental common sense, will be gigantic and expensive. I should mention that while burning natural gas does produce CO2, the CO2 output is 35% less than oil and 41% less than coal for the same amount of energy produced. However, the methane that is the main molecule in natural gas is a much more potent greenhouse gas than CO2, so leakage from well and distribution systems probably make natural gas no better than coal or oil. And of course we should be doing massive research efforts for technologies that could become obvious alternatives to burning fossil fuels. I’ve mentioned cellulose-derived ethanol and oil from algae, although I don’t think those efforts will scale satisfactorily. If we get better at using sunlight to generate electricity to crack water cheaply to make hydrogen, instead of making it from natural gas with lots of CO2 released like we do now, an in-place natural gas distribution, storage, and combustion infrastructure would work just fine with hydrogen instead of methane. Burning hydrogen or using it in fuel cells would only produce water again, no CO2. Scientists are even experimenting with using sunlight to directly cook air and water into usable hydrocarbons, but like current hydrogen production, it’s much too expensive for now.

Closing thoughts? This is a hard problem to grasp because it’s so foreign to everyone’s experience. Oil exploration, production, distribution, and refining is a multi-trillion dollar industry with literally millions of players which is invisible to most of us. It’s really hard to grasp the scale and scope. The numbers are huge. At any given instant, the U.S. oil distribution system has well over 300 million barrels just moving through. Most people I talk to are surprised that we might be running low on oil. This reminds me of the status of the greenhouse gas and climate change issue before non-scientists popularized the problem and brought climate change awareness to the general public. However, in that case there were many more researchers independently obtaining similar results with careers depending on publication of peer-reviewed studies. The evidence of climate change showed up again and again in scientists’ work in their own specialities. In contrast, the petroleum research community is smaller, more insular and usually employed by the companies and governments controlling oil production, entities that often consider the data a strategic secret. The decline of oil is all the worse because expensive fuel is going to happen just as world climate and weather turns much harsher. Our response to natural disasters depends on fast mobilization of people and resources, which in turn depends on large quantities of affordable fuel for the emergency vehicles. Unlike climate change, no one can ignore this or be a skeptic for a few more years. By the end of 2011 we should see at least the beginning of the next cycle of production insufficiency, price spiking, and perhaps the beginning of the next recession. I think we’ll see $10/gallon within 5 years, long before most people are ready for it. I would prefer that we start preparations sooner rather than react as events unfold. The changes I allude to in the previous paragraph will be extraordinarily difficult and expensive. I’m concerned that we’ll be caught short with insufficient capital, time, and options to minimize pain, suffering, and mortality.

Acknowledgements. I wrote this because my son Gabe told me I needed a short, concise document if I wanted his congressional staff colleagues to read it. I’ve shown this to quite a few people, but 3 people were of particular assistance. My brother Andrew was my primary, very patient editor. Morgan Downey’s book provided the lion’s share of my facts and figures. He read the document and had several good suggestions which I incorporated. Gary Jones, an oil services industry veteran, had several good suggestions and a key comparison for oil, gas, and coal. Thanks all around.

Where did I get these ideas? Here’s some reading I’ve found useful–

The End of Cheap Oil, Campbell and Laherrere, Scientific American March 1998. This is the famous article in that triggered a lot of thought and controversy.

The books really helped me form my ideas–

Morgan Downey, Oil 101. This lays out oil and the business of oil is amazing detail, delivered in a very matter of fact tone. Excellent, albeit heavy going in spots.

Jeff Rubin, Why Your World is About to Get a Whole Lot Smaller, Oil and the End of Globalization. This lays out the economic case. His claim that oil prices caused the recession made a lot of sense, and I’ve come to agree.

Christopher Steiner, $20 Per Gallon: How the Inevitable Rise in the Price of Gasoline Will Change Our Lives for the Better. This is a fun extrapolation of what industries will fail at what point as the price of oil goes up. Glosses right past the transition period, however.

Presumably, we’ll still have modern communications and the Internet in the years to come. Here are websites of interest–

http://peakoiltaskforce.net/ This is an industry group in the UK. Their 2010 Peak Oil Report is the best overview of the issue I’ve seen, with a nice section that reviews other reports. Their peak capacity figure is a bit high, which puts their “crunch” further out than others anticipate, but it’s still a good report.

http://www.eia.doe.gov/ The U.S. Department of Energy’s Energy Information Administration. Downey says the some of the best actual data is here.

http://scarcewhales.blogspot.com/ Morgan Downey’s blog. Very insightful, except he stopping posting awhile back. But I’ve been erratic too.

http://www.jeffrubinssmallerworld.com/ Jeff Rubin’s website. Go to his blog section for his current thoughts.

http://www.theoildrum.com/ This is a collection of sites I’ve found interesting.

http://en.wikipedia.org/wiki/Peak_oil Wikipedia has a very detailed article on the topic, with lots of clickable references

http://www.peakoil.net/ Colin Campbell and associates set this series of sites up.

http://www.energybulletin.net/primer This website pulls together information form multiple sites and sources. This page in a primer on peak oil.